Condo Insurance in and around Napa

Welcome, condo unitowners of Napa

State Farm can help you with condo insurance

Calling All Condo Unitowners!

Stepping into condo ownership is a big deal. You need to consider cosmetic fixes your future needs and more. But once you find the perfect townhome to call home, you also need terrific insurance. Finding the right coverage can help your Napa unit be a sweet place to call home!

Welcome, condo unitowners of Napa

State Farm can help you with condo insurance

Agent Mellissa Lopez, At Your Service

Things do happen. Whether damage from freezing pipes, vandalism, or other causes, State Farm has wonderful options to help you protect your condo and personal property inside against unpredictable circumstances. Agent Mellissa Lopez would love to help you develop a policy that is personalized to your needs.

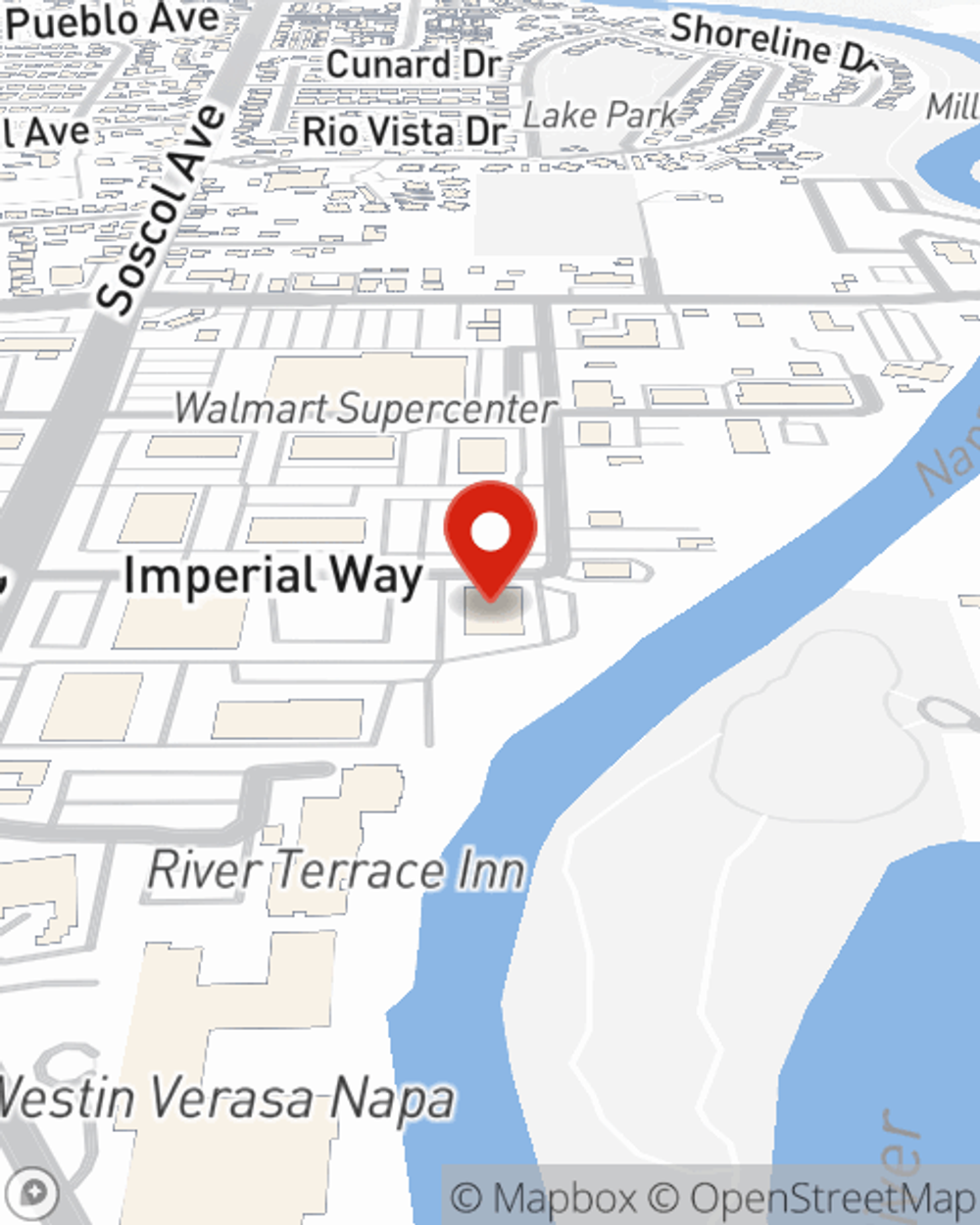

Finding the right protection for your condo is made easy with State Farm. There is no better time than today to visit agent Mellissa Lopez and explore more about your outstanding options.

Have More Questions About Condo Unitowners Insurance?

Call Mellissa at (707) 254-1994 or visit our FAQ page.

Simple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Mellissa Lopez

State Farm® Insurance AgentSimple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.